The steel industry is responsible for around 7% of global CO2 emissions and therefore holds a significant lever for tackling the climate crisis. Significantly more scrap is needed for greener steel production, but this could become a scarce commodity in international competition, as a preliminary study by the Supply Chain Intelligence Institute Austria (ASCII) and the Complexity Science Hub (CSH) shows.

In line with EU climate targets, 80 to 95% of CO2 emissions in steel production are to be reduced across the EU by 2050. “An important measure to achieve these targets is to switch to greener technology in steel production,” explains ASCII Director and CSH scientist Peter Klimek. “Countries with a strong steel industry – such as Austria, where steel production is responsible for 16% of CO2 emissions – are particularly affected.”

A key element in the changeover is the replacement of conventional, more carbon-intensive oxygen injection furnaces with electric arc furnaces powered by electricity. Scrap can be used in these to produce steel. This turns waste into a resource.

COMPETITION FOR SCRAP

However, the exploitation of this potential is closely linked to the scrap trade flows in the respective country and the availability of corresponding trading companies. “Greener steel production will depend on how much scrap is available on the market and whether the necessary infrastructure for transportation is in place,” explains Klimek.

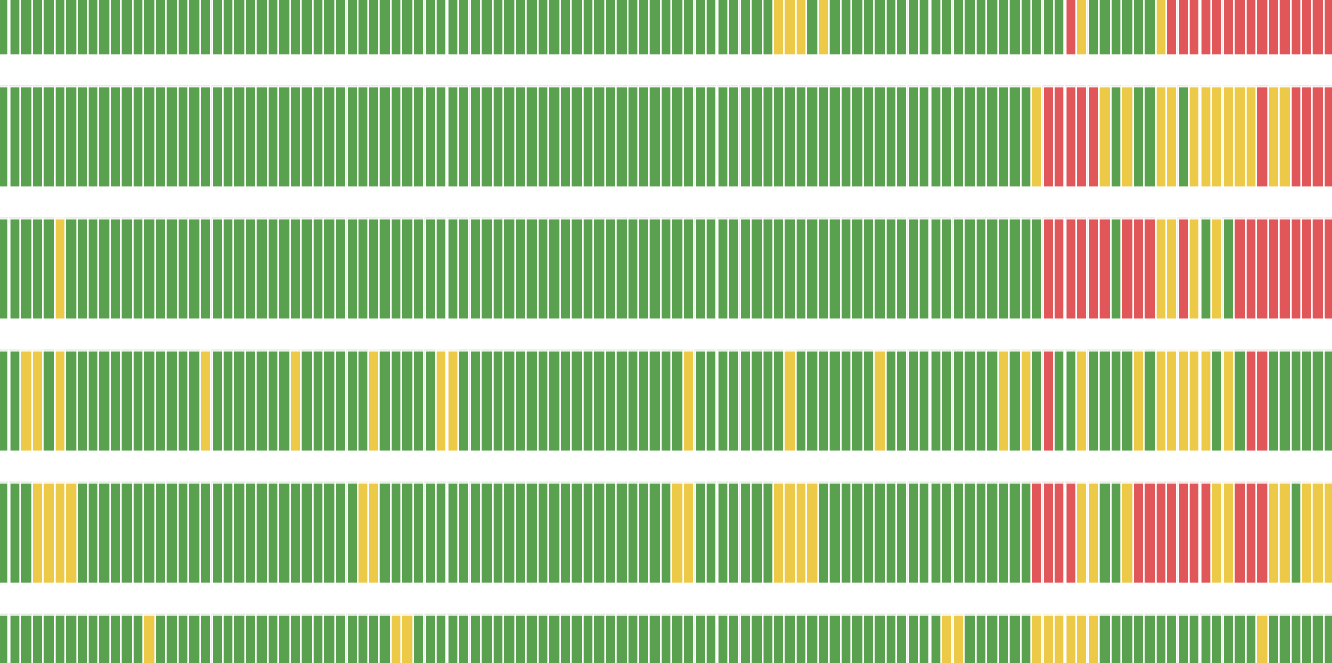

“Initial results of our research indicate that scrap could become a limiting factor in Europe,” says the researcher. The team of scientists from ASCII and CSH analyzed 15 years of trade data (2007 – 2021) together with information on more than 5,000 companies in the scrap metal trade. Their conclusion: in order to make steel production fit for the future and secure supplies, a far-reaching restructuring of the global and European scrap trade and a significant adjustment of the underlying corporate landscape are needed.

CHINA: ONE STEP AHEAD

In order to produce 1,000 tons of steel, it is necessary to plan for an annual increase in scrap imports of 550 tons and a decrease in annual exports of 1,000 tons. Scientists assume that scrap will become a strategic resource in the future, which will be accompanied by a massive restructuring of supply chains.

A fact that is already noticeable in the world’s largest steel producer – China. In recent years, scrap trade flows there have largely decoupled from the global market. “At the same time, many countries in Europe are currently relying on scrap exports and therefore run the risk of parting with a valuable raw material for their own industry,” explains Klimek.

According to the researchers’ findings, each additional scrap company could produce around 79,000 tons of steel in the EU using electric arc furnaces. “If we take this figure further, several hundred new companies could be required, which, according to our calculations, could in turn employ around 35,000 workers,” says CSH President Stefan Thurner.

JOINT PROJECT WITH VOESTALPINE

A joint project between ASCII and the Complexity Science Hub with voestalpine is now planned to investigate the feasibility of “green” steel production in Austria. The aim is to investigate both the market dynamics, including the availability of scrap, and possible logistical challenges.