The semiconductor industry is a cornerstone in contemporary technological infrastructure. Embedded in a complex industrial ecosystem it is shaped by regional specialization, evolving, and globally distributed firm networks, and technological innovations. To illustrate the semiconductor value chain and the importance of Austria’s industry in it, a team of ASCII scientists led by ASCII Director Peter Klimek analyzed the regional roles within the worldwide semiconductor value chain.

Their findings have now been published in a new report. The researchers are confident that it might serve stakeholders to better understand the semiconductor industry as an enabler for various core industries ranging from automotive to security, sensors, and various other industrial applications. “With this knowledge, concrete political strategies can now be developed to contribute to a resilient, sustainable and competitive industry location in Austria.” adds Klimek optimistically.

A novel approach for data-driven industry mapping

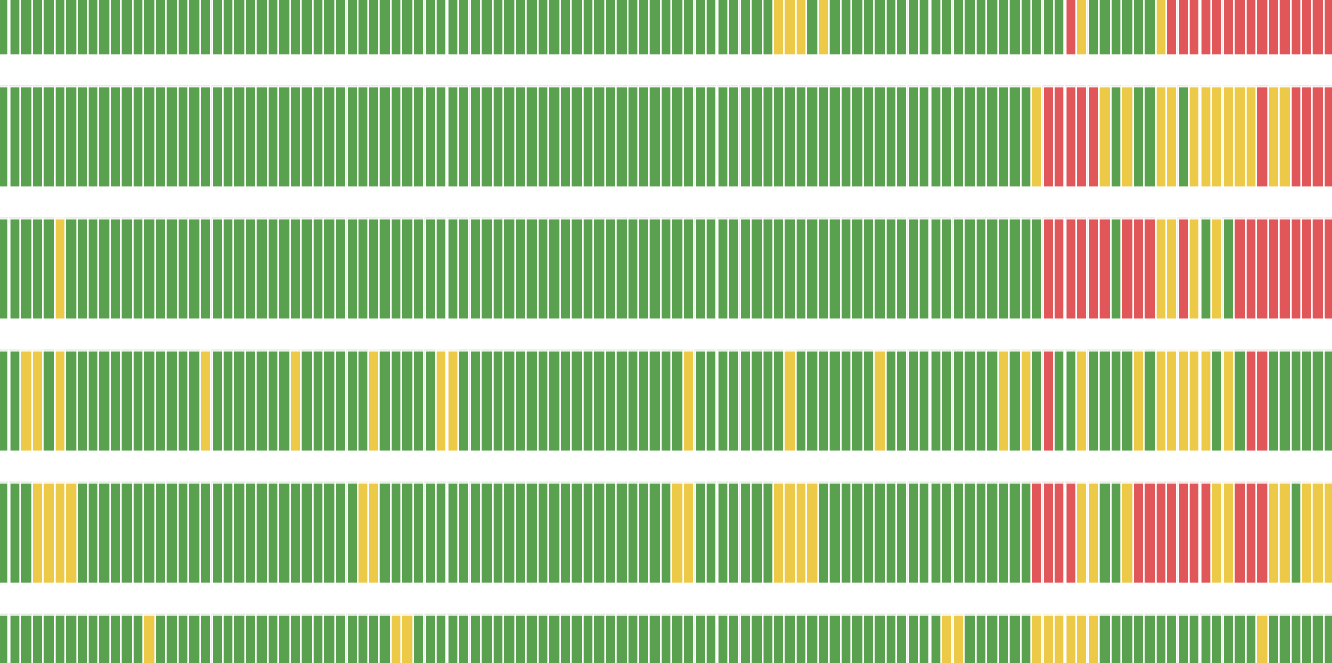

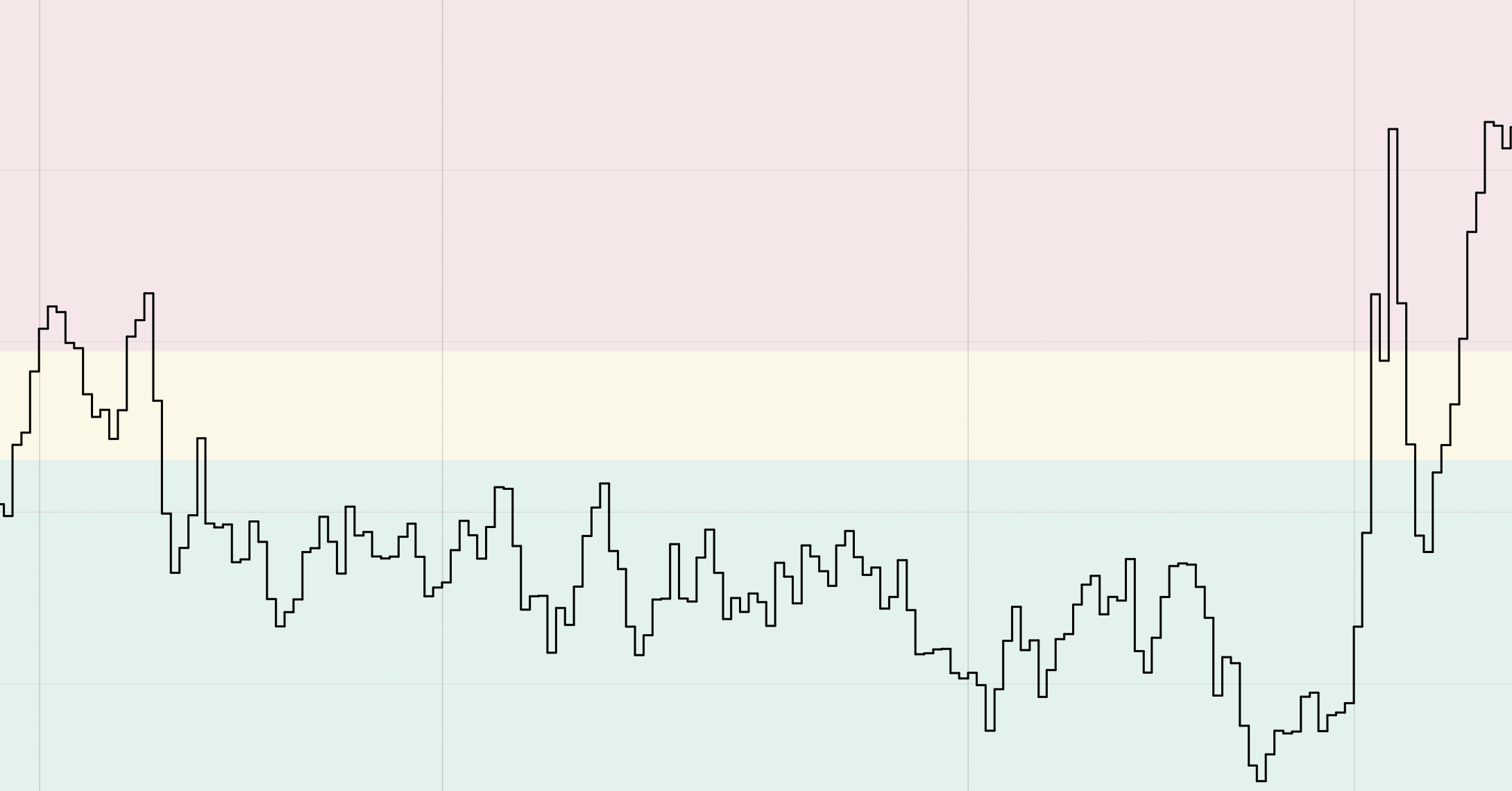

The team used a novel approach to perform a data-driven mapping of semiconductor companies combined with extensive and comprehensive trade data. Based on established formal models for stylized value chains in the industry, they mapped comparative strengths in exports of semiconductor-related goods across regions over ten years. In the process they identified several hundred leading companies in specific segments. A database of more than 20,000 semiconductor companies was built and their ties, such as joint projects, ownership, or customer-buyer relationships, were extracted from open web data. The resulting inter-firm networks were then used to examine the regional extent of these networks and how they change over time. The scientists also enriched the analysis with semantic clustering approaches to link companies to specific application areas and industries.

Distinct regional specializations

The report shows distinct regional specializations within the semiconductor value chain. China, Japan, and South Korea dominate critical manufacturing domains such as wafer fabrication and consumer electronics, while North America and European territories, excel across a diverse spectrum of application domains. “In terms of industry dynamics, inter-firm networks in the EU, US and China have synchronously rewired towards prominent chip design firms.” explains co-author and ASCII Deputy Director Markus Gerschberger.

Austria’s strength can be found in several product categories related to equipment for semiconductor production, inputs required for intermediate electronics, as well as intermediate outputs for industrial use. Austrian companies cover a multitude of applications such as power-management, Radio Frequency Identification (RFID), automotive electronics, and Near Field Communication (NFC).

Opportunities and implications

The report also highlights a few opportunities and implications for the semiconductor industry. Thus, for example advanced packaging has developed into a driving force for technological progress and innovation in various industries, enabling the integration of different technologies and the creation of small but powerful semiconductor devices. “We could detect a shift in the inter-firm network of Austrian companies towards the leading companies in the related value chain segment.” a development that – according to Klimek – promises to speed up innovations.

Further opportunities can also be found within emerging trends in the automotive and electric vehicle (EV) industries. EVs require twice as many chips as diesel cars and, along with autonomous driving, are introducing a host of increasingly intelligent applications to the automotive sector. These trends include investments in chip technologies, design innovation, energy-efficient paradigms, AI integration, high-performance computing capabilities and robust cybersecurity measures. Processes that are likely to drive innovation and could improve the competitiveness of Austrian companies by strengthening the link between the automotive and semiconductor industries.

In conclusion, the report provides valuable insights into the complex dynamics of the semiconductor industry, offering actionable knowledge to stakeholders for navigating the growing competition and changing demands.